Household budget worksheet excel Pc#

Q: How can I print my budget or save it as a PDF?Ī: If you're using a desktop/laptop, use the print menu in your browser or press Ctrl+P on a PC or Command+P on a Mac. Select 'Create new budget'.Īny budgets saved onto your computer or mobile device will appear in the menu. Q: How do I create and access multiple budgets?Ī: Click on the menu in the budget planner header. If you are looking for something more detailed, you could consider buying bookkeeping software.

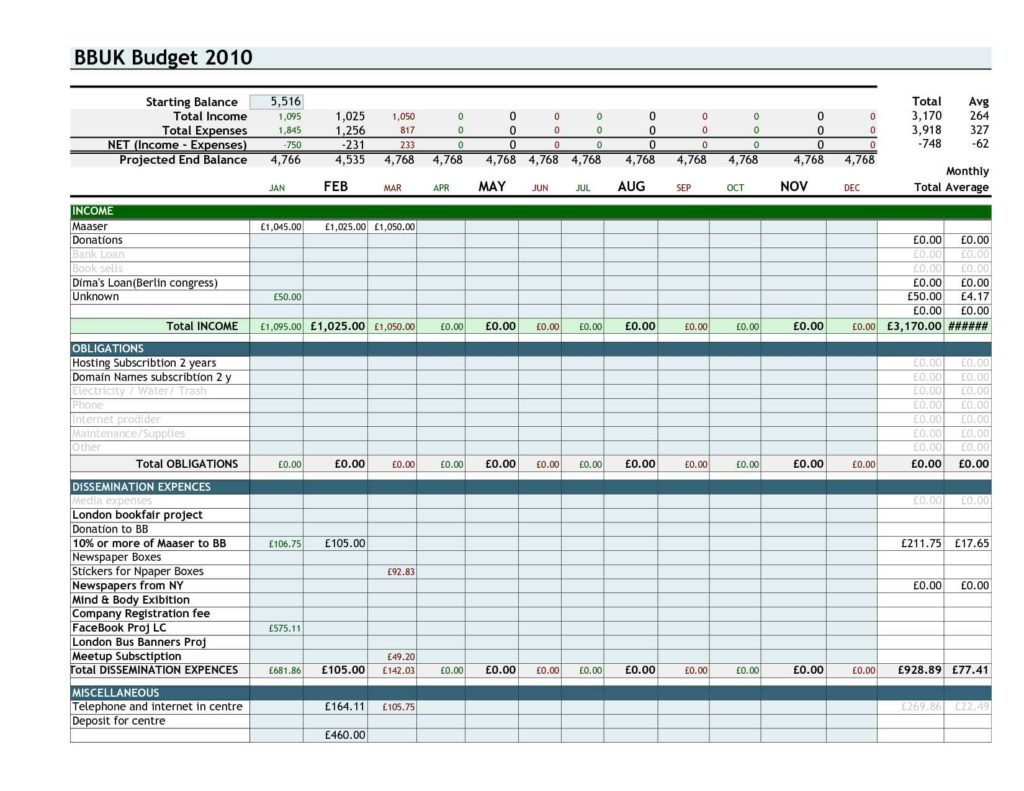

Household budget worksheet excel update#

We suggest you update your budget with actual income and expenses on a regular basis to make it as accurate as possible. Q: Can I set a monthly budget and compare this with actual income and expenses?Ī: No, the budget planner gives you a snapshot of what you spend your money on. You can also change the currency symbol under settings. But you can add your own sub items by clicking on the link. You cannot change the label of the default items in the budget planner. To add your own items, go to settings and choose "enable custom items". If you save it to your cloud storage, you can access it from multiple devices or share it with your partner.Ī: Yes. The Excel spreadsheet version allows for some customising (like renaming fields). Save the budget spreadsheet: Save your budget to your computer by using the Excel spreadsheet version.Disable the autosave function by switching to "off". Your data may be lost if you change your device or clear your cache. Autosave option: Your budget data is automatically saved onto your computer or mobile device, so you can come back to it later.Add these amounts back into your income, then include them in your expenses. Documentation required: For a more accurate picture of your finances, check your payslip for any deductions made in addition to tax (like superannuation, health insurance, company car).(Note: your results will be skewed if you don't set the right payment frequency.)

Frequency: Set payment frequency for each item - weekly, fortnightly, monthly, quarterly or annually.This calculator helps you work out where your money is going, and whether your income covers your expenses.

0 kommentar(er)

0 kommentar(er)